I’ve missed being able to blog but a bunch of stuff came up and I was swamped. Anyway there are a few things I wanted to get to. One is the silver futures market, the gold futures market and the oil futures market. If anyone has a start date for when silver was first traded on the futures market or if anyone has any info they want regarding these commodities let me know. I’ve had a number of requests to look at them over the next year. My intuition tells me that Sedna controls the silver market and I’d like to put that theory to the test and see how accurate it is.

Another thing is I’ve just started (barely) reading a book which is a best seller in South Africa but I couldn’t even find it on Amazon just now. It’s very akin to the theological discussions we’ve had on the blog. Before I recommend it I should probably read a little more of it to make sure it’s not nutty.

OK so let’s do the Gold thing right now since I have the chart of that and perhaps in the next few days when I have time I’ll do oil and hopefully by then anyone interested in silver will write in with the info I need to run a chart. As I look at the Dow’s chart I think silver will go up as gold becomes outrageous. That’s just a hunch based on some very good aspects coming up for Sedna in the Dow’s chart which I feel is related to silver, I need to do more research so don’t trust me entirely just yet. There’s another indicator in the Dow’s chart that gold is going to get stronger, more expensive as transiting North Node makes an exact sextile to the Dow’s Sun. This is starting to happen now. As people loose faith in real estate comes to a halt this will be the physical seemingly sure fire thing a lot of people will want to invest in.

I’ve been looking at the chart of the Dow and the futures charts for this year of both Gold and Silver. They have an almost identical trajectory, probably because they both fall under precious metal and people invest in both of them for the same reasons – security when the market seems scary. I’ve found some interesting discoveries. First when transiting Pluto 9n Capricorn is in the late 2 degree/early 3 degree margin this is when both Gold and Silver shine and go up. The trigger often seems to be a transiting Moon in Aquarius. At first I thought this was odd and then it hit me. People invest in precious metals when they feel insecure about the market, when the moon transits the Dow’s chart in late Aquarius investors start feeling a case of the nerves. Also Aquarius is ruled by Uranus and Uranus is a big part of the sudden rise and fall of everything in the Dow’s chart. Pluto is also a big culprit as it rules massive amounts of money and power. Transiting Pluto has been going back and forth over the Dow’s natal Moon since the first major fall of the market last fall and has been flirting with disaster ever since. It is only due to the propping up of the market and a false bubble created by our government and the world governments that the market hasn’t completely collapsed on itself. I know everyone thinks the stimulus package was stupid but the truth is if we didn’t have it we would be in a very serious depression right now. The reason being is the bubble of protection and security it gave people, corporations and investors. It restored confidence and that is 9/10ths of the way the market works, psychology.

I still have to figure out the Sedna thing but the following should be a good start.

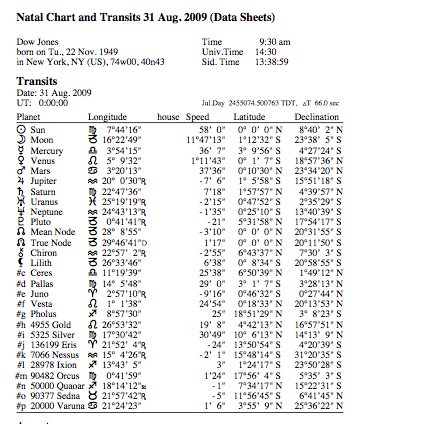

So back to Gold and Silver: I have added the asteroids Silver and Gold which both (upon inspection) also seem to have a great effect on the rise and fall of those metals. Here are the charts, interpretation to be given afterward:

So from what I can discern there should be a general downward movement from here on until around the 25th of November of 2009, then a general upward flow until about the 22 of December 2009. Around the 22-29 of January 2010 there should be a strange unexpected sudden spike triggered by very bad news on the housing front. This is about when the market really falls out in the housing market. It will remain bad for several years, so buying is best during this period until about 2012, but selling is not so great. The instability of the market and the world will make precious metals go up until mid-end of February 2010 and then it will start to go down again. Another turn for the better in mid-May of 2010 then a turn downward toward the end of June 2010 and then a big high around August of 2010 rising up throughout the rest of that month until 3/4 of the way through September of 2010. Down from there until we get to a sudden spike toward the end of November of 2010 that will last for 2-3 weeks and back down it will go. 2011 precious metals will most likely be much cheaper to buy and will start to trend (overall) toward the downside, rectifying itself to what the true value of the precious metals actually are rather than what people have anticipated them to be.

Hope this helps!

Best wishes to all,

Denise

You write that in 2011 precious metal prices will come down to what their true value will be, I am paraphrasing. What can be the true value of a finite commodity be when the dollar to buy it is literally being printed and given away? From what I understand all of the gold in the world could fit into a couple of large swimming pools. And from what I understand of silver there has not been a major find in decades. It is used in the manufacture of many products and supply is not increasing. Also if you read Ted Butler he has said for the years that the gold and specifically silver prices have been manipulated on the COMEX by just a couple of banks one of which is JP Morgan. This being done to keep the price down so people won’t look at gold and silver as an alternative to paper money. All of these things too must influence the price of gold and silver.

I own silver on two exchange traded funds DBS and SLV. I own gold through the exchange traded fund GLD. I own mining stocks in through the exchange traded fund GDX and mutual fund FSAGX. Plus I own several small mining company shares. Any thoughts here? Do you have any thoughts regarding owning the metal itself compared to owning it on exchange traded funds? Many people do not trust ETF’s and think the metals aren’t all there. Any thoughts of the US government confiscating gold and silver like gold was in the early 30’s? And since these are all priced in US dollars, what are your thoughts on it? Many people think its value is going to go to peso levels. That being the plan and the only way the US could ever pay its debts.

When you look at oil could you include natural gas in that?

Alf Field’s Gold Price Predictions

Posted: May 10 2009 By: Jim Sinclair Post Edited: May 10, 2009 at 8:06 pm

Filed under: General Editorial

Dear CIGAs,

The following is Alf Field’s Gold price predictions:

We are presently in Major Up Move Three.

Major ONE up from $256 to $1,015 (actually 4 times the $255 low);

Major TWO down from $1015 to $699, say $700 (a decline of 31%);

Major THREE up from $700 to $3,500 (a Fibonacci 5 times the $500 low);

Major FOUR down from $3,500 to $2,500 (a 29% decline);

Major FIVE up from $2,500 to $10,000 (also a 4 fold increase, same as ONE)

more from Jim Sinclair

May 27, 2009

Martin Armstrong-Alf Fields-Gold Predictions

Filed under: Confidence Model, Dollar Crisis, Economic Crisis, Fiat Currency, Hyperinflation, Hyperinflationary Depression, Martin Armstrong, The Dollar Crisis, The Financial Crisis — Tags: Alf Fields, Martin Armstrong — totallygroovygirlfriday @ 8:04 am

Jim Sinclair gave a summary of the next move in gold and the USDollar. He agrees with Martin Armstrong and Alf Fields and others. Check out my blog roll for his website link. The bolded items are my comments.

Jim says that the bull gold market will be Alf Fields’ price in Martin Armstrong’s timing.

The punch line: gold will begin its third wave up in June. This wave will top at least $3500.

From Jim Sinclair Predictions:

1. Gold reacts as currency support for the dollar enters mid June to a slow decline (that is the official definition of a strong dollar policy, really). Gold is now trading as a secure currency, not a commodity. This is a completely different type of investor/investment.

2. End of 2nd week going into the beginning of the 3rd week of June Gold launches towards $1000 and this time through the neckline of the reverse head and shoulders formation. Update August 24, 2009…we are still going sideways, battling deflation, trend to change soon. Wait for it….wait for it.

3. Gold rises to $1224 where it hesitates.

4. The OTC derivative market takes on the dollar as short sellers into dollar support.

5. This OTC derivative currency short position builds.

6. It is the US dollar where Armstrong will get his WATERFALL. Martin has predicted a waterfall effect. This means a quick plunge, never to return. The US Dollar is soon to be toast. Get out NOW. This drop will be so quick, that you will not have time to move investments out of the dollar when it is clear you should do so. Especially, if all your assets are dominated in dollars.

7. The main selling (for the dollar) takes place when Israel makes a major miscalculation. The timing for this is 2011.

8. Hyperinflation is always and will continue to be a currency event. The government will continue to print money and a hyperinflationary depression will occur in the US. Timing for the start is 2011-2012.

9. Hyperinflation will be a product of the upcoming massive OTC derivative short dollar raid.

Should I be correct in the gold price action going into late June, it will fit Armstrong’s criterion for a move to $5000.

Alf’s work permits an over-run of the gold price to $3500 in the major 3rd phase, indicating overruns into the major 5th. Translation….Martin is predicting a major move in gold to $5000. If he is correct, Alf Fields’ prediction of $10,000 per ounce before the bull market is over (during the 5th wave) is completely conceivable.

Do not think you will make a huge ROI on gold and silver. Gold and silver will be so ridiculously high, because the dollar will be crushed, never to return to its value of today. It will throw all the global fiat curencies of the world on edge.

The rules of investing are totally different than they have been the last 25 years. This is a world wide currency crisis, a systematic breakdown. Your focus is to PRESERVE capital, especially if your investments are in USDollars. I can not stress this point enough.

What is the “Dow” you refer to in text and charts? Gold/metals have nothing to do with the DJIA (index of 30 stocks).

Gold and silver use to be the only money and has been used for thousands of years. The

federal reserve note issued by the US government’s dollar was backed by gold until 1971. Everyone knows how much it has gone done since then. They are now borrowing and printing money like never before. This is one of the most important topics I can think of and no one has responded. I am no psychic but I think everyone soon will be discussing this.

I wish they would here.

Any thoughts on the Saturn/Uranus opposition this month??

Any thoughts on mining stocks such as GDX or the HUI indexes? Do you see Israel attacking Iran any time soon? If yes will other countries become involved?

From Jim S. comment:

I have some CDs at the bank for retirement pourpose and kids collage money (they are now 9 and 5 y/o). I thought that using CDs to buy physical gold or other precious metal to make more profit was a better strategy. But with your posting, now I’m not sure…What would you suggest? What do you mean by preserve capital? What options should I consider?

“Do not think you will make a huge ROI on gold and silver. Gold and silver will be so ridiculously high, because the dollar will be crushed, never to return to its value of today. It will throw all the global fiat curencies of the world on edge.

The rules of investing are totally different than they have been the last 25 years. This is a world wide currency crisis, a systematic breakdown. Your focus is to PRESERVE capital, especially if your investments are in USDollars. I can not stress this point enough.”

From Jim S. comment:

I have some CDs at the bank for retirement purpose and kids collage money (they are now 9 and 5 y/o). I thought that using CDs to buy physical gold or other precious metal to make more profit was a better strategy. But with your posting, now I’m not sure…What would you suggest? What do you mean by preserve capital? What options should I consider?

“Do not think you will make a huge ROI on gold and silver. Gold and silver will be so ridiculously high, because the dollar will be crushed, never to return to its value of today. It will throw all the global fiat currencies of the world on edge.

The rules of investing are totally different than they have been the last 25 years. This is a world wide currency crisis, a systematic breakdown. Your focus is to PRESERVE capital, especially if your investments are in US Dollars. I can not stress this point enough.”

Barry,

Seems like Sinclair’s prediction on gold reaching 1224$ and then hesitating for a bit was dead on.

US Mint stops sales of Gold coins, physical gold dries up. Well, if supply is diminished and demand is enormous that would indicate the price must be suppressed…temporarily that is.

Will be interesting to see what happens when hyperinflation kicks in, and the currency devaluation is imposed on the worlds people.