I’ve missed being able to blog but a bunch of stuff came up and I was swamped. Anyway there are a few things I wanted to get to. One is the silver futures market, the gold futures market and the oil futures market. If anyone has a start date for when silver was first traded on the futures market or if anyone has any info they want regarding these commodities let me know. I’ve had a number of requests to look at them over the next year. My intuition tells me that Sedna controls the silver market and I’d like to put that theory to the test and see how accurate it is.

Another thing is I’ve just started (barely) reading a book which is a best seller in South Africa but I couldn’t even find it on Amazon just now. It’s very akin to the theological discussions we’ve had on the blog. Before I recommend it I should probably read a little more of it to make sure it’s not nutty.

OK so let’s do the Gold thing right now since I have the chart of that and perhaps in the next few days when I have time I’ll do oil and hopefully by then anyone interested in silver will write in with the info I need to run a chart. As I look at the Dow’s chart I think silver will go up as gold becomes outrageous. That’s just a hunch based on some very good aspects coming up for Sedna in the Dow’s chart which I feel is related to silver, I need to do more research so don’t trust me entirely just yet. There’s another indicator in the Dow’s chart that gold is going to get stronger, more expensive as transiting North Node makes an exact sextile to the Dow’s Sun. This is starting to happen now. As people loose faith in real estate comes to a halt this will be the physical seemingly sure fire thing a lot of people will want to invest in.

I’ve been looking at the chart of the Dow and the futures charts for this year of both Gold and Silver. They have an almost identical trajectory, probably because they both fall under precious metal and people invest in both of them for the same reasons – security when the market seems scary. I’ve found some interesting discoveries. First when transiting Pluto 9n Capricorn is in the late 2 degree/early 3 degree margin this is when both Gold and Silver shine and go up. The trigger often seems to be a transiting Moon in Aquarius. At first I thought this was odd and then it hit me. People invest in precious metals when they feel insecure about the market, when the moon transits the Dow’s chart in late Aquarius investors start feeling a case of the nerves. Also Aquarius is ruled by Uranus and Uranus is a big part of the sudden rise and fall of everything in the Dow’s chart. Pluto is also a big culprit as it rules massive amounts of money and power. Transiting Pluto has been going back and forth over the Dow’s natal Moon since the first major fall of the market last fall and has been flirting with disaster ever since. It is only due to the propping up of the market and a false bubble created by our government and the world governments that the market hasn’t completely collapsed on itself. I know everyone thinks the stimulus package was stupid but the truth is if we didn’t have it we would be in a very serious depression right now. The reason being is the bubble of protection and security it gave people, corporations and investors. It restored confidence and that is 9/10ths of the way the market works, psychology.

I still have to figure out the Sedna thing but the following should be a good start.

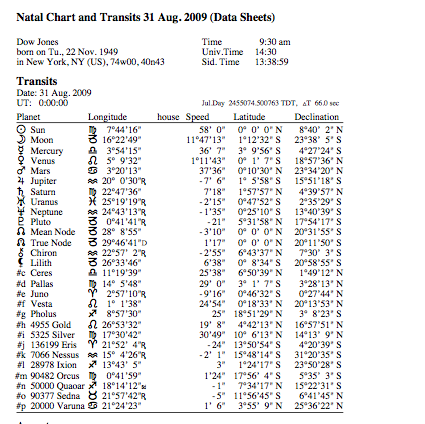

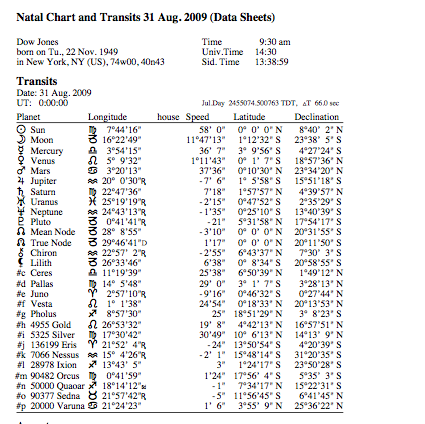

So back to Gold and Silver: I have added the asteroids Silver and Gold which both (upon inspection) also seem to have a great effect on the rise and fall of those metals. Here are the charts, interpretation to be given afterward:

So from what I can discern there should be a general downward movement from here on until around the 25th of November of 2009, then a general upward flow until about the 22 of December 2009. Around the 22-29 of January 2010 there should be a strange unexpected sudden spike triggered by very bad news on the housing front. This is about when the market really falls out in the housing market. It will remain bad for several years, so buying is best during this period until about 2012, but selling is not so great. The instability of the market and the world will make precious metals go up until mid-end of February 2010 and then it will start to go down again. Another turn for the better in mid-May of 2010 then a turn downward toward the end of June 2010 and then a big high around August of 2010 rising up throughout the rest of that month until 3/4 of the way through September of 2010. Down from there until we get to a sudden spike toward the end of November of 2010 that will last for 2-3 weeks and back down it will go. 2011 precious metals will most likely be much cheaper to buy and will start to trend (overall) toward the downside, rectifying itself to what the true value of the precious metals actually are rather than what people have anticipated them to be.

Hope this helps!

Best wishes to all,

Denise