More questions! I’ll get to as many as I can tonight and the rest over the next couple of days.

Hi Denise,

Thanks for the reply. In regard to further info,

OZ Minerals is a merger between 2 companies – Oxiana and Zinifex.

The name OZ Minerals was approved by share holders on 18 July 2008 and started trading under that name on 23 July 2008. Hope this is sufficient info.

God Bless

Gurdeep

Hi Gurdeep,

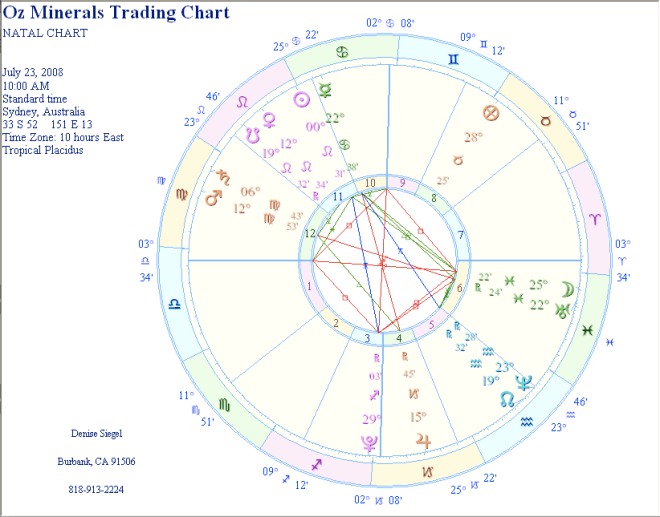

Thanks for the info. Here is Oz Mineral’s founding chart:

The first chart I can’t be sure of the time, I used the start trading time of Australian Stock Exchange so I’m going to go on the second chart which will be more accurate and also be more appropriate as it will apply to those people who own stock in this company.

The first chart I can’t be sure of the time, I used the start trading time of Australian Stock Exchange so I’m going to go on the second chart which will be more accurate and also be more appropriate as it will apply to those people who own stock in this company.

I would say there will be losses as Neptune returns to 23 degrees Aquarius in the 5th house in February of 09 but then as Uranus hits Mercury in the company’s 10th in March of 09 and trines natal Uranus and the Moon in the company’s 6th house there unexpected productivity which will lead to unexpected profits especially seen about a year later in April of 2010 when this aspects completes itself with a trine to the part of fortune in the 8th (investors). That will also be when (more toward the end of April but still, very close) when Mars will hit the company’s Venus (ruler of the 8th) and Neptune will be out of the 5th house of speculation and making an applying sextile to Pluto in the 3rd house from the 6th, which means there could be loss of some jobs as the company relocates or opens up another division somewhere else and lets some people go in the process, but it’s not a huge loss of jobs or anything. If you’re going to sell I’d wait until that period of time, it looks much better at that time. This stock will rebound and you will very likely regain any losses or make money if you wait it out until then.

Next from Barry:

For the people that have taken your advise and sold stocks and went to cash this year, when do you adivse investing again? I have a lot of cash in a money market fund in my 401k waiting to do this. I have a choice of 2 US domestic bond funds, 1 foreign fund and several US domestic stock funds. What would you invest in and when would you start? Thanks for doing this.

Hi Barry,

I can’t give you a logical answer like an investment person would only an intuitive one. Personally, I would wait until at least March of 2011 when Uranus moves out of Pisces and into Aries. Things will be more hopeful, and there will be much more market confidence in certain areas by then. But I have a caveat, Pluto will be going through Capricorn (which rules business, major corporations and markets) until 2024 and Neptune through Pisces until about 2025, which means we are going to see the end of business, capitalism and the markets as we have known them.

There is going to be major restructuring throughout the next (nearly) 20 years. And this will be on a global scale. You will have to really educate yourself not just the history of the markets, and any funds you are interested in, but you will also have to be able to follow all the nuisances, and changes that will be perpetually coming.

I know some financial people are saying there won’t be a depression, others are saying it will be the worst depression we’ve ever known. But truly, I don’t think either are correct. This is going to be a period unlike anything we’ve seen. I don’t feel it will resemble the 30s except on the very surface. I have a feeling the world will work together to solve this crisis as I’ve posted long before there was any talks of this or foreign leaders coming together, etc.

There will be a period of adjustment and I don’t think financial people really have a clue just how radically things are going to end up changing. As I’ve said before I feel there will be international laws put into place not just regarding lending, but on trading as well, the markets will somehow be tied together in a new way, and instead of this hodge podge of pieces there will be a uniting off all markets into a truly global economy. But this will take many years, and happen piece by piece.

So to better answer your question, please post or e-mail me (so you can remain anonymous if you wish) specific funds and a time frame so I can do a yes/no spread about them. The trend here I’m seeing is too big, and wide, that I can’t see the trees inside this forest unless you point them out.

Also a shout out to anyone who has some advice on foreign and domestic funds, perhaps a break down of what’s positive and negative to help out Barry and all other readers. I’m a psychic/artsy fartsy type I’m not a hedge fund manager so I can’t logically answer this question it’s too broad for me. Give me something I can do a chart on or a tarot reading about!

Dear Denise,

you are awesome. Thanks for taking the time and write to us all.

I am holding stock from the company AUY. Do you see the price going back up to between 10 to 30?

Thanks a lot,

keep up the great work,

Ninja

Hi Ninja,

I’m mental with the stock symbols. Can you please post the name of the company and if you have the date it started trading and where that would be ideal, in case I don’t have it in my database.

Sorry about that for now, but I will answer you when I can run a chart. Or if you have a specific yes/no question I can do that, too.

Hi Denise,

I thought you and everyone would find this article/interview interesting. The financial strategists mention that around Valentines Day as the potential bottom of the market. This coincides with everything you’ve been saying about the first wave of the worst ending late January of next year. Thanks to everyone who shares their thoughts and of course, Denise who shares her insight, gift and wit. I look forward to you all every day.

“Pros Say: No Market Bottom ’til Valentines Day

The Big 3 U.S. automakers may have reached a bailout compromise Thursday – or not. Citigroup shares hover near $5, even after mega-investor Saudi Prince Alwaleed bin Talal said he’d boost his Citi stake to 5 percent. Strategists told CNBC to expect more volatility – and no bottom for months yet.

http://www.cnbc.com/id/27824439/ “

Thanks for the information Hope and a Plan!

Denise: Will there be a bailout for the American public or are lawmakers going to continue down the wrong path of bailing out their business buddies?

These stimulus packages Obama wants aren’t designed well enough. Because my business pays almost nothing in taxes due to our HUGE equipment write-offs, I’m not provided any of the stimulus.

Just curious if this bailout madness is going to either stop or come to who really needs it?

Thanks!!!

P.S. LOVE your blog. Don’t stop! Wish I could afford your private readings… ![]()

Hi Chris,

This is an excellent question! It seems like the country has cancer of the eyeball and they are doing radiation on our femur. It’s kind of insane. I’m hopeful that it will get better with the new administration, but lets see what the cards say.

I asked if the new administration would focus on bailing out the people instead of big corporations.

The answer: No.

But it’s not as bad as it seems. There will be change and much more help to those who need it. But it won’t be as much as many would like or think is necessary. The problem is they will keep trying to bail out companies to “save jobs” but they will also most likely extend unemployment benefits, pass health-care reform and also try to help people keep their homes, stuff like that, but by comparison it really won’t be commensurate with what they are doing for these big businesses that have been mismanaged, and deserve to go the way of the dodo for their idiocy and overpaid moronic CEOs. The money they spend bailing these companies out (which in my opinion those CEOs should have to sell all their assets off first and live like normal human beings if they ran their company into the ground, then they should loose their jobs and have to worry about money like anyone else does) would be better spent on education and on restructuring these companies.

I don’t know if anyone saw Michael Moore on Larry King tonight, but he had a great idea; basically bail out the car companies, but take them over, kick out their management, and have them producing hybrids, mass transit vehicles, and cars that run on everything other than gas. I guess FDR took over the automotive industry when he came into office, and had them manufacturing airplanes, tanks, etc. for the war effort. Moore felt the government should take over the companies if they’re going to give them 25 billion, and make them help solve our reliance on oil in the process.

Moore was of the same split mind as most of us. These auto makers have been refusing to make good quality desirable products for the past 30 years, and now they want a hand out! It’s despicable and causes an immediate gag reflex before the repercussions of their failure hit the conscious mind. Moore had a good point. If these jobs go under there will be a huge ripple effect. And we can’t afford millions more jobs lost. So maybe socializing the auto industry not just by giving them money, but by actually making them do something productive would be a way out of the mess.

I doubt, however, this sort of strategy will be enforced. I’m sure this bail out will happen before the Obama administration gets in, and it maybe too late for the Obama administration to implement that idea depending on how the deal goes down. Let’s hope for all our sake congress uses their collective brain cell to figure this one out before signing off on our money like they did last time.

The second bail out package shouldn’t have happened, it did no good! The first one I believe would have made a difference, but so much was compromised, and ruined trying to get the Republicans on board that the bill was castrated. The only good that bill did was restoring a little faith that our government had a desire to solve the mess our country created. I think it bought us a little bit of diplomacy and that’s about it.

These questions will be answered over the next couple of days!

Best wishes and many blessings to all,

Denise

thanks so much for your blogs. I really enjoy coming back here. You have predicted a stock market “Tsunami” for December. Things are so extremely bad already… how much worse can it get…? Do you see the Dow Jones Index going below 6000 in December…? Also, do you expect Deflation or Inflation in 2009? Are they going to print so much money that the dollar becomes completely worthless and we will finally need a new currency, or o you see the dollar getting stronger, like right now?

Thanks a lot in advance,

your advice is truly appreciated!

If Obama chooses Hillary for the Sec of State job, will she be a team player and represent him to well or will she be a disappointment to Obama?

Will Gov. Richardson be offered a position in the Obama Administration?

What a gift this is! Aquarian breadth with Piscean depth taking on all the issues of our times. I truly hope you’ll pursue publishing this. I can’t be the only one needing this vision, this hope, and this inspiration.

Thank you, thank you, thank you!

Yours,

Tina

From Americhrist, 2008/11/21 at 5:38 PM

Hello again. Here is a unique question. When within the next 75 days would you recommend a marriage date for these two people? Born 7/28/56 Chillicothe, Ohio and 8/17/80 Olongapo, Philippines. Any other advise would be appreciated too. Thank you again.

Will Tim Geitner be a good Secretary of Treasury?